4 Hour Binary Options

03:47 Because traders are not concerned with how much an, only the direction, a 1 Hour Strategy is considered ideal for effectively identifying medium-term price movements for profitable high frequency trading. So what is a 1 Hour Binary Options Strategy? Generally, that expire between 5 minute and 1-2hours are considered to have a medium-term expiration. Using lower time frame price charts such as 1-minute, 5-minute and 15-minute chart, a 1 hour binary option allows traders the flexibility to trade and time to strategically analyze the market, therefore creating more opportunities for traders for profit. What is the multiplier in forex.

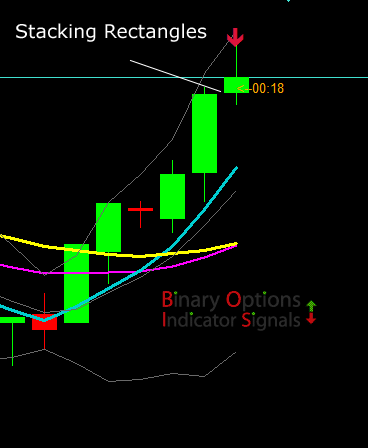

Binary options charts have not always been of high quality when delivered direct from brokers – as discussed in more detail below. That is changing however, particularly with established CFD and spread betting brokers entering the binary options market. Learn our 1 hour binary options strategy using PSAR breakouts, brought to you by Investoo.com. Join Investoo.com today and learn to trade in more than video lessons and trading courses.

Binary Options Brokers

A 1 hour binary option can refer to any binary options contract which has a one hour expiry time, whether the contract is of the,,, Touch/No Touch, Tunnel or Range binary option varieties. Trading a Flat Market The possibility exists that, given an assets price, that it will neither increase or decrease in value during a pre-defined option period and rather trade in a narrow range, ending the period at more or less the same level at which it began. That is, when an assets price is stable and lacks volatility during a trading period, a flat (or sideways) market is identified. Human nature typically overlooks trading a sideways markets. How to Trade in a Sideways Market Because a binary option contract is effectively asking a ‘yes’ or ‘no’ question – that is, for example: will the price of be greater than or less than $1,394.00 at expiry given its current trading price of $1,393.40 the smallest of price change above or below the expiry price can render a trade a loss (or out-of-the-money).

With this knowledge, if the trader believes the price will be greater than $1,394 at expiry, they will place a Call trade. If they believe the price will be less and $1,394, they will place a Put trade.

If alternatively, the trader believes the market will remain relatively flat (trendless and moving sideways) for the remaining period until contract expiry, the trader is able to initiate a high probability flat market trade to capitalise on this with just a 1 hour expiry. How to Trade a 1 Hour Sideways Market for Profit and Low Risk At 1.20AM Spot Gold is trading at $1,393.40 and you (as the trader) believe the market will remain flat and continue to trade within a very narrow price range. With the knowledge that the closer to expiry the binary option is, the lower the percentage payout (known in options trading as Time Decay)– a Put trade is entered on the Spot Gold: $1,394.00 (2.20AM expiry) option with a percentage payout ratio of 85% on a $25 trade. If at expiry, Spot Gold $1,394.00, the trade is a 100% loss. At 1.50AM the Spot Gold market has, as per your prediction, remained flat. However, because the contract is now closer to expiration, and there is a lower probability that Spot Gold price will exceed $1,394.00, the percentage payout amount drops to 38%. That is, the bid/offer percentage payout amount has reduced to 38/62% (put/call).

4 Hour Binary Options

At this point, if there is a suspicion that price volatility may change, a trader can exit the position (a call trade) at 62% (from the put 85% trade) for a net gain of 23% per contract traded or $30.75. Alternatively, the position can be held until expiry and if the Spot Gold price is still below $1,394. What forex pairs to trade. 00, the Put trade will be successful and expire in- the- money for a $46.25 profit. If Spot Gold price is above $1,394.00 the trade will expire out-of-the-money at a 100% loss.