Forex From The Bank

The Canadian dollar today rallied to new highs against most of its peers including the US dollar after the announced its interest rate decision in the early American session. The loonie’s rally was further boosted by the hawkish tone in the bank’s monetary policy statement, which investors interpreted as hinting at more rate hikes in future.

Forex the industry's most popular trading platform and experience it with FxPro's professional bank conditions. See how our main trading platforms stack deutsche against each other fine going to our platform comparison page.

Forex From Icici Bank

The USD/CAD currency pair today dropped from a high of 1.3100 in the European session to a low of 1.2984 after the BoC announcement. The currency pair today traded in a range from the Asian session into the European session before suddenly dropping to new lows after the BoC announcement. Point to 1. binary options trading how top 75% from the previous 1.50%, which was in line with market expectations. The rate hike forced the pair lower as the loonie rallied higher and overpowered the US dollar, which was quite strong at the start of the session. The pair then retraced some of its losses before heading lower.

The hawkish tone adopted by where it cited the recent US, Canada and Mexico trade deal as being a major positive for the Canadian economy among other factors was interpreted as being hawkish by investors, which boosted the loonie. The pair’s future performance is likely to be influenced by geopolitical events and global crude oil prices. The USD/CAD currency pair was trading at 1.2984 as at 16:08 GMT having dropped from a high of 1.3100. The CAD/JPY currency pair was trading at 86.72 having rallied from a low of 85.  83.

83.

Forex Bank Trading Strategy Explained (Updated 2018) • Who is Smart Money? • What is the Forex Bank Trading Strategy? • Why is Tracking ‘Smart Money’ Critical to Successful Trading • Step 1: Accumulation • Step 2: Manipulation • Step 3: Distribution/Market Trend Who is ‘Smart Money?’ Throughout this article, you will read the term ‘smart money.’ I use this term to define the largest market participants; those who move massive volume so large that their position cannot be opened and closed in a single order without spiking the market. This includes the largest banks, prop firms, massive global companies, insurance companies, Hedge Funds, as well as speculative traders in every variety from around the globe. It is important to understand that although the banks might control the majority of the daily volume, the VAST majority of that volume is those banks acting as a market maker for the other types of traders mentioned above. Yes, banks do take speculative positions, but the vast majority of the volume they transact on a daily basis is for the purpose of market making, not speculation.

Forex From The Banking

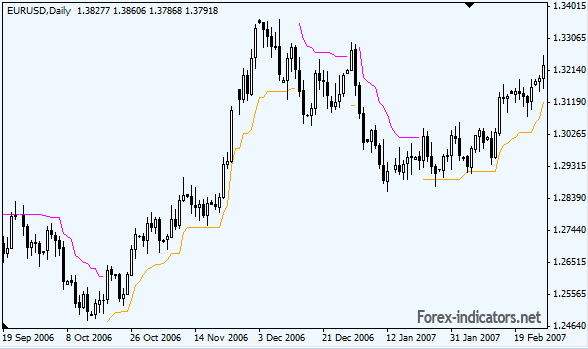

This is critical information, as it tells us 1 very important clue. If banks are primarily market makers then they will by default drive the market to and from areas of supply and demand which is the foundation in how we track them. What is the Forex Bank Trading Strategy? Definition: The Forex Bank Trading Strategy is a trading setup designed to identify where large market participants are likely to enter or exit their position based on likely areas of supply and demand, or manipulation points as we term them. As you can see in the chart above, the top 10 banks control well over 60% of the daily forex market volume. What if you could determine where they were likely buying or selling?

Do you think this information would be profitable? Tracking smart money is at the very foundation of the bank day trading strategy. If we can consistently reveal where the smart money is entering, and the direction they are trading, then we have all the information we need to make a profitable trading decision.

We must remember that this is the banks market, and not ours! Retail traders are figurative flies on the wall.

Keeping that in mind, why then do most retail forex traders out there attempt to invent or learn forex trading strategies that have been created to try and fit a market we do not control? It is our strong conviction at Day Trading Forex Live that success in the forex market is only possible when we stop trying to fit different rules to a market we don’t control, but rather learn the trading strategy of the banks! This is their business, and they have a business model (aka forex trading strategy) that we must learn to follow to achieve consistent results! We do this through the repeatable 3 step process described below. If we learn to trade forex by following their model we will have a much greater chance of success; after all the banks are the ones moving the market! 3 Steps To Success In any market, there must be a counterparty to every transaction. If you are looking to buy the market someone must be willing to sell to you.