How To Open A Forex

This is the first and most important step in opening any forex account. You can choose the best forex broker by looking for such factors as the credibility of a broker, their trade execution, low. In the past, when opening a forex trading account, you’d also have to choose whether you wanted to open a “standard” account, a “mini” account, or a “micro” account. Now, that isn’t much of a problem since most brokers allow you to trade custom lots. Opening your first forex position, especially when it is done in the real money forex platform, can be a thing of trepidation for the new trader. No matter how long a trader has practiced on a demo account, hitting it off on the real money platform is a whole different ball game.

This item: How to Start Your Own Forex Signal Service: The Next Step Every Forex Trader Should Take to Build an Automated Passive Income Stream. Set up a giveaway Customers who viewed this item also viewed. Page 1 of 1 Start over Page 1 of 1. This shopping feature will continue to load items. You’re probably wondering how to start Forex trading from home. Well, you are in the right place.  It doesn’t matter if you’re in the U.S., Nigeria, India or anywhere else in the world. In this guide, we will show you the EXACT process you need to follow if you want to build a successful Forex trading business.

It doesn’t matter if you’re in the U.S., Nigeria, India or anywhere else in the world. In this guide, we will show you the EXACT process you need to follow if you want to build a successful Forex trading business.

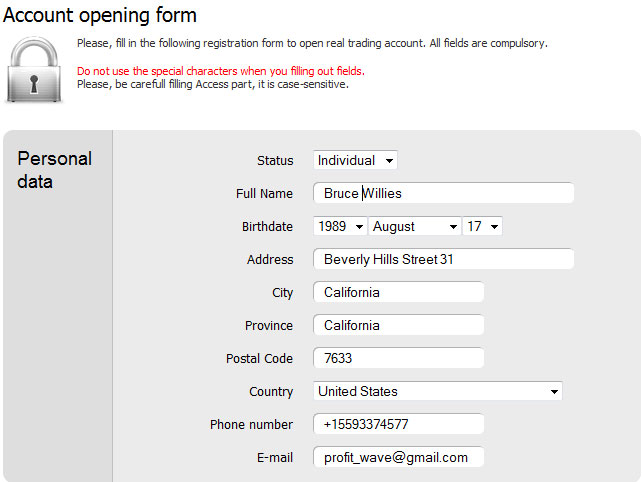

Open A Forex Trading Account

So you’re thinking about starting your own forex managed account? You’ve come to the right place! I consider myself the pre-eminent expert within the industry of Forex MAM’s, PAMM’s and managed accounts. Here’s why you should listen to what I have to say: – I’m the managing director of both and – I oversee $10mil+ of investor capital across MAM’s and PAMM’s at – We have 6 years experience running trade copying, regulated and unregulated structures. This is me presenting in Shanghai to a group of investors. First thing– What is a forex managed account?

A, a MAM or a PAMM is essentially the same thing. An investor allocates money for you to trade on their behalf and agrees to pay you a fee. FYI – the difference between a MAM and a PAMM is in the way trade sizes are apportioned to investors. PAMM’s give more flexibility whereas MAM’s give more transparency to investors.

The process of trading for your investors under this model varies slightly from broker to broker, but it normally looks something like this: • Your investor signs an LPOA (limited power of attorney) allowing you to trade their account for them, and agrees a fee structure. • They fund their account with the broker allocating the capital to your master account (sometimes called a MAM master). • You’ll see money drop in and out of the master account when clients deposit and withdraw. • You trade the master account and (hopefully) make both your clients, and yourself, lost of money • Each month the broker will transfer your agreed fee, ready for withdrawal to your bank account.

How does home advisors work. There are 3 different ways for you to earn income from your managed account. Performance fee Paid when you make your clients money (equity gains, remember that your balance is fugazi. All we care about as traders are equity gains) This is the best kind of fee because it aligns your interests with those of your investors.

How To Open A Forex Brokerage

It’s how we structure all our managed accounts. Under a performance fee model, you’re only making money if the clients are also making money. Like a perfect marriage, your goals are aligned. Rebates You earn a slice of the spread every time you open and close a trade. I hate traders who charge their investors rebates.