Limit Orders Banks Forex

“Would you like pips with that?” Okay, not that type of order. The term “order” refers to how you will enter or exit a trade. Binary options brokers in canada. Here we discuss the different types of forex orders that can be placed into the forex market. Be sure that you know which types of orders your broker accepts. Different brokers accept different types of forex orders. There are some basic order types that all brokers provide and some others that sound weird.

Order Types Market order A market order is an order to buy or sell at the best available price. For example, the bid price for EUR/USD is currently at 1.2140 and the ask price is at 1.2142. If you wanted to buy EUR/USD at market, then it would be sold to you at the ask price of 1.2142. You would click buy and your trading platform would instantly execute a buy order at that exact price. If you ever shop on Amazon.com, it’s kinda like using their.

You like the current price, you click once and it’s yours! The only difference is you are buying or selling one currency against another currency instead of buying a Justin Bieber CD. Limit Entry Order A limit entry is an order placed to either buy below the market or sell above the market at a certain price.

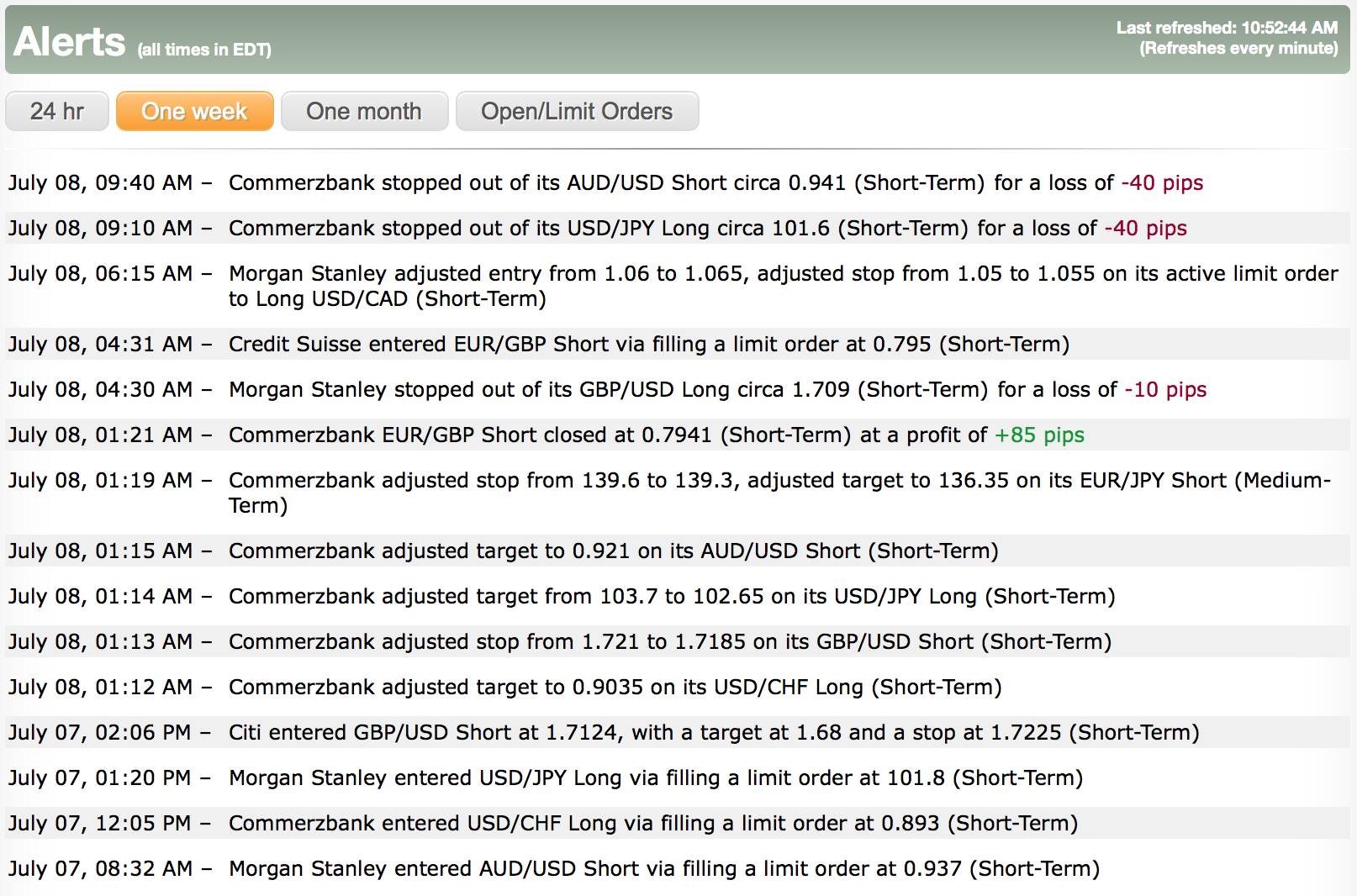

Point of entry into the market of forex video. Limit order When it comes to a limit order, you get to specify the price you want to pay for the stock. You get favorable pricing, but you may not get filled with your order if your price is not met. But banks are also platforms where investors give forex trade orders. These orders are known as bank orders forex where it is a bank who acts as the medium for forex trading. Investors who prefer a bank as trading platforms instead of online trading platforms often have a huge sum at their disposal, a sum which they deem too large for open. A limit order is an order placed with a brokerage to execute a buy or sell transaction at a set number of shares and at a specified limit price or better. Premier forex trading news site. Founded in 2008, ForexLive.com is the premier forex trading news site offering interesting commentary, opinion and analysis for true FX trading professionals. Once the market reaches up the level of the limit order, the currency is sold at a profit but when he market falls, the stop-loss order is used. Stop Order The last one is Stop Order, which is an order to buy above the market or to sell below the market.

Limit Orders Banks Forex Online

Current price is the blue dot. For example, EUR/USD is currently trading at 1.2050. You want to go short if the price reaches 1.2070. You can either sit in front of your monitor and wait for it to hit 1.2070 (at which point you would click a sell market order). Or you can set a sell limit order at 1.2070 (then you could walk away from your computer to attend your ballroom dancing class). If the price goes up to 1.2070, your trading platform will automatically execute a sell order at the best available price. You use this type of entry order when you believe price will reverse upon hitting the price you specified!

Limit Orders Banks Forex Calculator

Stop Entry Order A stop entry order is an order placed to buy above the market or sell below the market at a certain price. Current price is the blue dot. For example, GBP/USD is currently trading at 1.5050 and is heading upward. You believe that price will continue in this direction if it hits 1.5060. You can do one of the following to play this belief: • Sit in front of your computer and buy at market when it hits 1.5060 OR • Set a stop entry order at 1.5060. You use stop entry orders when you feel that price will move in one direction! Stop Loss Order A stop loss order is a type of order linked to a trade for the purpose of preventing additional losses if the price goes against you.