Strategy Fibonacci Binary Options

FiboTrend – following binary options strategy is a rather complex combination of quite a few indicators. It is not a simple system to say the least and at the same time the results aren’t that impressive in relation to the amount of work or time it takes to trade based on this strategy. Who is this strategy ideal for? Without a doubt, the Fibonacci trend following binary options strategy is ideal only for advanced traders. It takes into account quite a few indicators and the odds of success with this strategy depend on how well a trader understands this system.

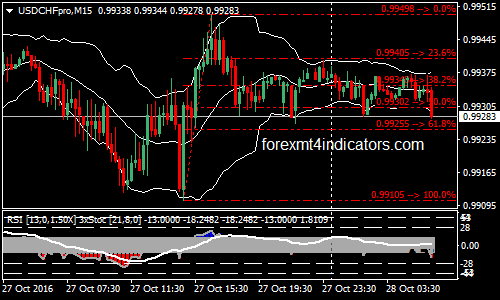

The starting point of the Fibonacci time zone strategy is to be able to draw it correctly on the charts, understand what the vertical lines signify and then use the information derived therein to create a strategy for trading the binary options market. Increase Profits In Binary Options Trading With Fibonacci 80% Retracement When using Fibonacci retracement levels, the golden ratio of 61.8% is undoubtedly the most important, however it is not the only level which should be considered during trading. Binary options trading system with Fibonacci A lot of traders use Fibonacci retracements to trade online, because they can influence the levels of the prices on the market. Now we will try to use them to make a good profit on binary options: Fibonacci binary options strategy. Fibonacci Retracements in Binary Options. In binary options trading, Fibonacci retracements is a method used by traders to perform technical analysis specifically to determine support and resistance levels.

Many successful binary options strategies are based on the Stochastic Oscillator but what exactly is this technical indicator all about and why is it so effective? A brief introduction to the stochastic oscillator strategy is now presented in order to provide answers to these important questions. How To Use The Stochastic Oscillator Hey Traders, I hope you are fine.In the previous article I talked about three ways for taking trades after a reversal.In this article I will make some comments for my today trades and I will explain how I use the stochastic oscillator for an extra confirmation in my trades. Stochastic indicator for binary options.

Successful Binary Options Strategy

Fibonacci Strategy for Binary Options Trading The following is a description of a Fibonacci strategy that can be used in trading the Touch/No Touch binary options. It is a long term strategy that can produce a huge payout. Fibonacci Strategy for Binary Options Trading. The following describes how to use the Fibonacci retracement tool to identify possible points at which the price of the asset could retrace to, and use these points as a basis of setting price targets for the Touch/No Touch trade. The reason why it is preferred to use the Betonmarkets platform for this strategy is as follows: a) The Betonmarkets platform allows the trader to choose his own expiry. Being able to choose your own expiry time affords you some flexibility to play around with.

Fibonacci Binary Options

B) The payout structure on Betonmarkets is such that the most improbable of trades will cost the trader very little and pay out more. This strategy is played out on a daily chart where the trade outcome is not very obvious. For such trades, Betonmarkets easily price those bets in such a way that the trader can easily aim for a payout of 100% of even more. Let us now give a description of the strategy. Trading the Touch/No Touch with the Fibonacci Retracement Tool For the Fibonacci strategy, we will use the daily chart for our analysis. The concept behind this strategy is to identify areas to which the price of the asset will retrace to after a particularly strong trend. The only way to get the trend of the asset is to watch its price behaviour over a length of time, and this can only be done using the daily charts.

The core of the strategy is built around the Average True Range (ATR) MT4 indicator and the buysellmagic02 custom indicator. A long entry. 1.0 Strategy Long Entry Rules Enter a buy position if the following indicator or chart patterns are on display: • If the line of the ATR moves higher, it is signaling increasing volatility, as such traders will be anticipating rapid price moves. Chart Setup MetaTrader4 Indicators: buysellmagic02.ex4 (default setting), ATR.ex4 (14) (default setting) Preferred Time Frame(s): Any Recommended Trading Sessions: Any Currency Pairs: Majors and cross currency pairs Download Buy Trade Example Fig. average true range forex The ATR does not give us wind of the direction price is going to go, hence well confirm entry on “rule 2.” • If the buysellmagic02 custom indicator forms a lime colored upward pointing arrow that is aligned below price bars, it is an indication that price is bullish i.e.