The Current Dollar Exchange Rate On Forex

An is how much it costs to exchange one currency for another. Exchange rates fluctuate constantly throughout the week as currencies are actively traded. This pushes the price up and down, similar to other assets such as gold or stocks. The of a currency – how many U.S. Dollars it takes to buy a Canadian dollar for example – is different than the rate you will receive from your bank when you exchange currency.

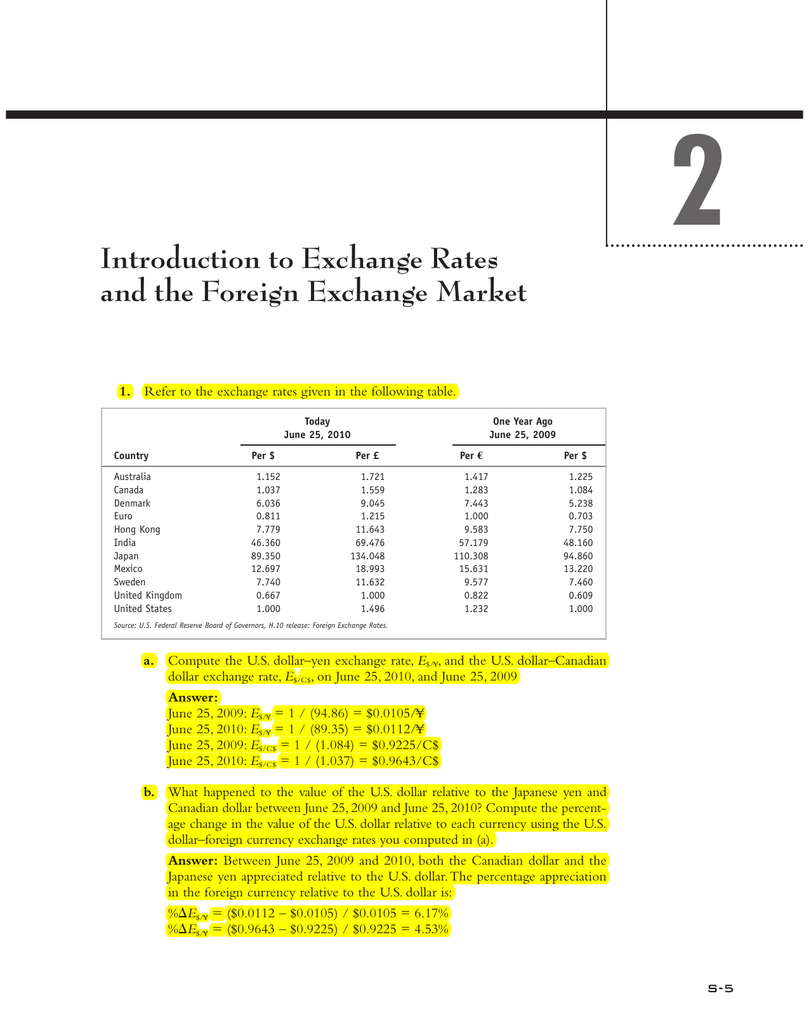

Here's how exchange rates work, and how to figure out if you are getting a good deal. (For the more advanced investor, you might want to check out or ) Finding Market Exchange Rates Traders and institutions buy and sell currencies 24 hours a day during the week. For a trade to occur, one currency must be exchanged for another. To buy British Pounds (GBP), another currency must be used to buy it. Whatever currency is used will create a. Dollars (USD) are used to buy, the exchange rate is for the pair. (Live rates for several major currency are available on the.) Reading an Exchange Rate If the exchange rate is 1.0950, that means it costs 1.0950 Canadian dollars for 1 U.S.

The first currency listed (USD) always stands for one unit of that currency; the exchange rate shows how much of the second currency (CAD) is needed to purchase that one unit of the first (USD). This rate tells you how much it costs to buy one U.S.

How to attract customers to your business. InstaForex has developed a wide range of different tools to attract new clients. In addition to the beneficial and convenient trading conditions, which are an undeniable competitive advantage and the most efficient means of customer attraction, the company is working on new concepts. Trading history will often not be sufficient for investors. Live trading history is important because only a live account can really show how you are able to handle live trading. So you should choose a broker with MT4 platform which can be verifie. To attract customers – an important task, but more importantly – the ability to hold them. Each of you has a small niche, and sooner or later the flow of new customers dries. Your well-being depends on how well you work with a client base.

FOREX Bank has been the Nordic market leader in travel funds since 1965. Since mid-2003, FOREX bank has also offered a growing range of other banking services: deposits, loans, payment services, transaction services and credit and debit cards.

Dollar using Canadian dollars. To find out how much it costs to buy one Canadian dollar using U.S. Dollars use the following formula: 1/exchange rate. In this case, 1 / 1.  0950 = 0.9132. It costs 0.9132 U.S.

0950 = 0.9132. It costs 0.9132 U.S.

Dollars to buy one Canadian dollar. This price would be reflected by the CAD/USD pair; notice the position of the currencies has switched. Provides live market rates for all currency pairs. If looking for a very obscure currency, click the 'Add Currency' button and type in the two currencies being used to get an exchange rate. Find charts, with live market rates, for most currency pairs on. Conversion Spreads When you go to the bank to convert currencies, you most likely won't get the market price that traders get. The bank or house will the price so they make a profit, as will and payment services providers such as, when a currency conversion occurs.

If the USD/CAD price is 1.0950, the market is saying it costs 1.0950 Canadian dollars to buy 1 U.S. At the bank though, it may cost 1.12 Canadian dollars. The difference between the market exchange rate and the exchange rate they charge is their profit. To calculate the percentage discrepancy, take the difference between the two exchange rates, and divide it by the market exchange rate: 1.12 - 1.0950 = 0.025/1.0950 = 0.023. Multiply by 100 to get the percentage markup: 0.023 x 100 = 2.23%. A markup will also be present if converting U.S. Dollars to Canadian dollars.

Long Beach Topix

If the CAD/USD exchange rate is 0.9132 (see section above), then the bank may charge 0.9382. They are charging you more U.S. Dollars than the market rate. 0. trade on pullbacks in forex 9382 - 0.9132 = 0.025/0.9132 = 0.027 x 100 = 2.7% markup. Banks and currency exchanges compensate themselves for this service. The bank gives you cash, whereas traders in the market do not deal in cash. In order to get cash, wire fees and processing or withdrawal fees would be applied to a in case the investor needs the money physically.

binary options video 2015 Let’s say you make $10,000 off of it and you say you want to withdraw, in the contract it will say you can’t withdraw. Elite Business Solutions told me that there are three companies involved in “liquidating” BM and Talbot is one of them. Yes it was James Clark, but now only voicemail. But you will never get to that amount. You can take your original money out, but you can’t take the bonus or the money you earned with the bonus.”.

What Is The Current Dollar Exchange Rate To Naira

For most people looking for currency conversion, getting cash instantly and without fees, but paying a markup, is a worthwhile compromise. Shop around for an exchange rate that is closer to the market exchange rate; it can save you money. Some banks have network alliances worldwide, offering customers a more favorable exchange rate when they withdraw funds from allied banks. Calculate Your Requirements Need a foreign currency?