Wave Analysis Forex How To Do

Applying the wave principle on the market, a trader can give an accurate forecast of the price behavior at a certain period. This type of market analysis can ensure success in trading and can prove to be a really effective tool for a professional trader.

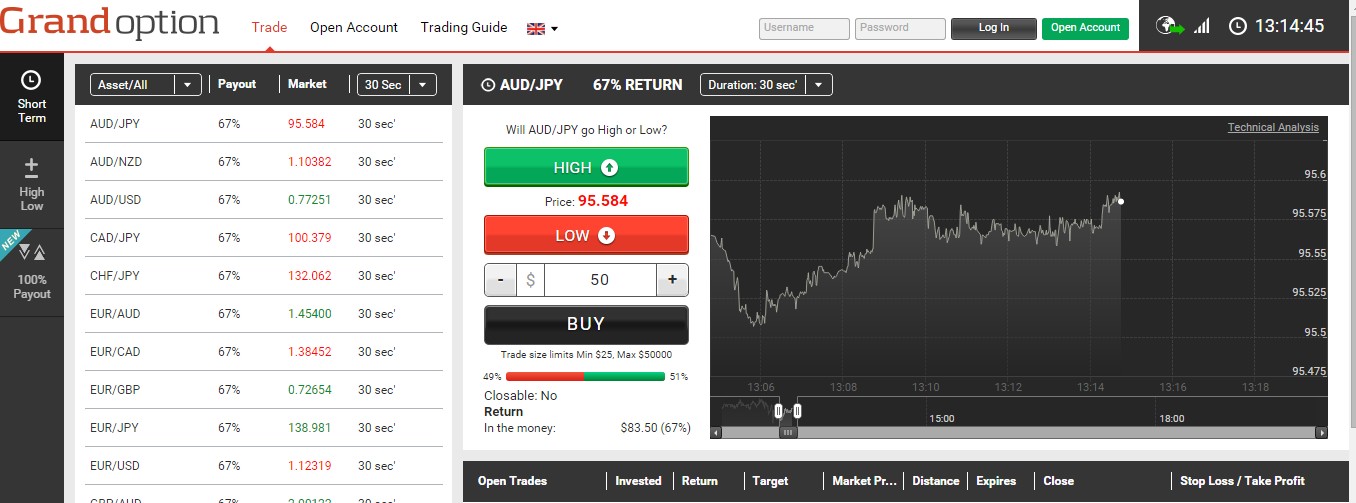

How to Trade Forex. Trading foreign exchange on the currency market, also called trading forex, can be a thrilling hobby and a great source of income. To put it into perspective, the securities market trades about $22.4 billion per day; the forex market trades about $5 trillion per day. The wave analysis Forex is one of the methods of technical analysis. This type of analysis was named after the Wave Theory introduced by professional accountant Ralph Nelson Elliott in his book The Wave Principle published in 1938. The latest Elliott Wave analyses of the FOREX markets. Millions of traders are trading the euro, dollar, yen, pound and other currencies every day now. Elliott Wave helps them make sense of all the ups and downs and gives them an edge. Elliott Wave Analysis: AUD/USD Support At 0.7190. Forex (or FX or off-exchange foreign currency futures and options) trading involves substantial risk of loss and is not suitable for every.

How to apply the wave analysis? According to the Elliott Wave Theory, a price movement of any currency pair can be depicted on a chart in the form of waves.

How to apply the wave analysis? According to the Elliott Wave Theory, a price movement of any currency pair can be depicted on a chart in the form of waves.

Wave Analysis Forex How To Do Technical

Waves are divided into three impulse waves that go with a trend and two corrective ways that move in the opposite direction. These waves are labeled with the numbers 1,2,3,4,5. When the trend formation becomes less active, the price correction starts that is depicted by three waves on a chart. Two of these waves are impulsive and the third one is corrective. These ways are labeled as A,B, and C. /binary-options-strategy-is-a-win-win.html.

The main idea of the wave analysis is that the price movement is regular; one and the same pattern repeats itself over and over again. When traders apply the wave analysis on Forex, they can foresee the price movement at a certain stage of the trend. If traders enter the market on the right wave and close a deal in time, they can make a profit. To reduce losses on Forex and set a stop loss level correctly, traders should pay attention to the length of the waves. As a rule, the longer the impulsive waves are, the longer the corrective waves will be. The most difficult thing in applying the wave analysis is to define the type of a wave correctly.

In order to give an accurate forecast of the price movement, it is necessary to tell apart the impulsive and the corrective waves. Usually, the corrective waves are the hardest to recognize. The Elliott Wave theory is applicable to any traded asset – from shares and bonds to the EUR/USD currency pair.

USDJPY may continue lower as we see a turn down from the highs as a leading diagonal; thus start of a new change in trend that will ideally resume through 112.94 bearish level, while pairing trades below 114. Binary signals and coding in computing pdf. 20 invalidation level. USDJPY 1h USDCAD is in a similar trend; also turning south quite aggressively which can be a wave A of a bigger corrective set-back which can take pair even back to 1.3055 this month. That said, before 1.3055 can be reached, we need to wait for a new temporary three-wave set-back to the 1.320 area as wave B. • Grega Horvat Grega is based in Slovenia and has been involved in markets since 2003. He is the owner of, but before that he was working for Capital Forex Group and TheLFB.com. His feature articles have been published on FXstreet.com, Thestreet.com, Action forex, Forex TV, Istockanalyst, ForexFactory, Fxtraders.eu, Insidefutures.com, etc. He recently won the award on FXStreet.com for Best Forex Analysis in 2016.

At he helps clients and educates them about the Elliott wave principle and how to label and track unfolding patterns in real time. His approach to the markets is mainly technical. He uses a lot of different methods when analyzing the markets such as candlestick patterns, MA, technical indicators etc. His specialty, however, is Elliott Wave Theory which could be very helpful especially if you know how to use it in combination with other tools/indicators.

How To Write An Analysis

EW-Forecast To be involved in the market effectively, you need the right guidance and resources, and our team can help you to achieve that. Our team is providing advanced informations about Elliott Wave theory in real time. The Elliott Wave Principle gives you a method for identifying the behavior of the markets and at what points the market is most likely to turn. We help new traders who are interested in Elliott Wave theory to understand it correctly. We are doing our best to explain our views as simple as possible with educational goal, because knowledge itself is power! Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors.